How much should the average American invest today to feel financially secure in the future? It’s a pressing question—especially with inflation, tech disruption, and economic uncertainty reshaping long-term planning.

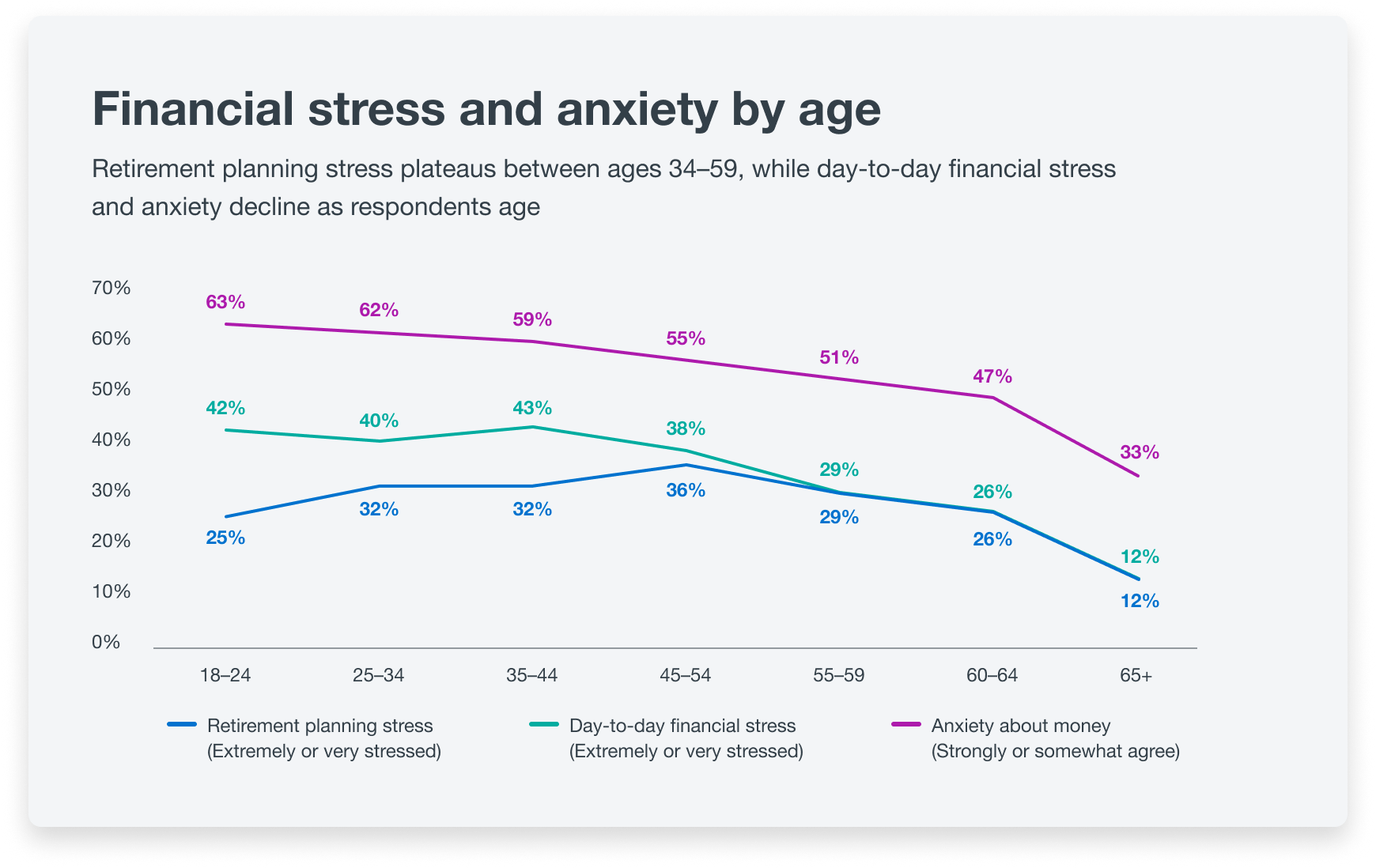

A new survey by Sadoxis Capital Management , conducted during Financial Literacy Month, reveals that 61% of Americans are concerned about making poor investment choices —especially those aged 28 to 44. Among younger adults (18–24), 63% reported high anxiety about managing their finances. Financial stress has become a daily reality for nearly 6 in 10 Americans.

The findings also show a shift in mindset: Americans have increased their target financial safety net by nearly 30% in just 12 months—from $700,000 to $900,000—driven by inflation, market volatility, and long-term uncertainty.